How much do banks usually lend for mortgages

We Service Many Of Our Home Loans Have A Variety Of Financial Products Services. DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

Scotiabank Fixed And Variable Mortgage Rates Sep 2022 Special 4 85 Wowa Ca

801010 loans consist of a first mortgage 80 and a second mortgage 10 that total.

. Ad Compare Best Mortgage Lenders 2022. We Service Many Of Our Home Loans Have A Variety Of Financial Products Services. Lock Rates For 90 Days While You Research.

Get Your Estimate Today. Were not including additional liabilities in estimating the income. The setup fees range from GBP500 to 1 of the loan amount which would probably cover the set up costs so i think its safe to say the banks are making 3 to 35 on the mortgage funds they.

Apply Now With Quicken Loans. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Ad Competitive RatesFees Online Conveniences - Start To Apply Today.

For example FHA loans allow you to borrow up to 975 of the homes value. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. For this reason our calculator uses your.

In my experience its usually about 85 of the purchase price. Mortgage-backed securities can be purchased at most full-service brokerage firms and some discount brokers. Ad Schedule an Appointment at Your Convenience at a Bank of America Near You.

Lenders placing caps on borrowing. Theyre generally not going to lend more than the house. They can also earn early commission and tracking where they receive some monthly payments during the.

When demand is low such as during an economic recession like the Great Recession which officially lasted between 2007 and 2009 banks can increase deposit interest. Dont Settle Save By Choosing The Lowest Rate. How income multiples affect your borrowing chances Banks and building societies will usually lend a maximum of four-and-a-half times the total annual income of you and anyone else.

The minimum investment is usually 10000. Get The Service You Deserve With The Mortgage Lender You Trust. Mortgages are already paid by the mortgage lender when the loan is taken out.

If you put 50 down you should be all set regardless. When you apply for a mortgage how much youll be able to borrow is usually capped at a multiple of your annual earnings. Apply Online Get Pre-Approved Today.

However there are some MBS. Ad Compare Mortgage Options Calculate Payments. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Just how much banks let you borrow depends on the value of the property. Ad Competitive RatesFees Online Conveniences - Start To Apply Today. Find out how much you could borrow.

Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI.

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

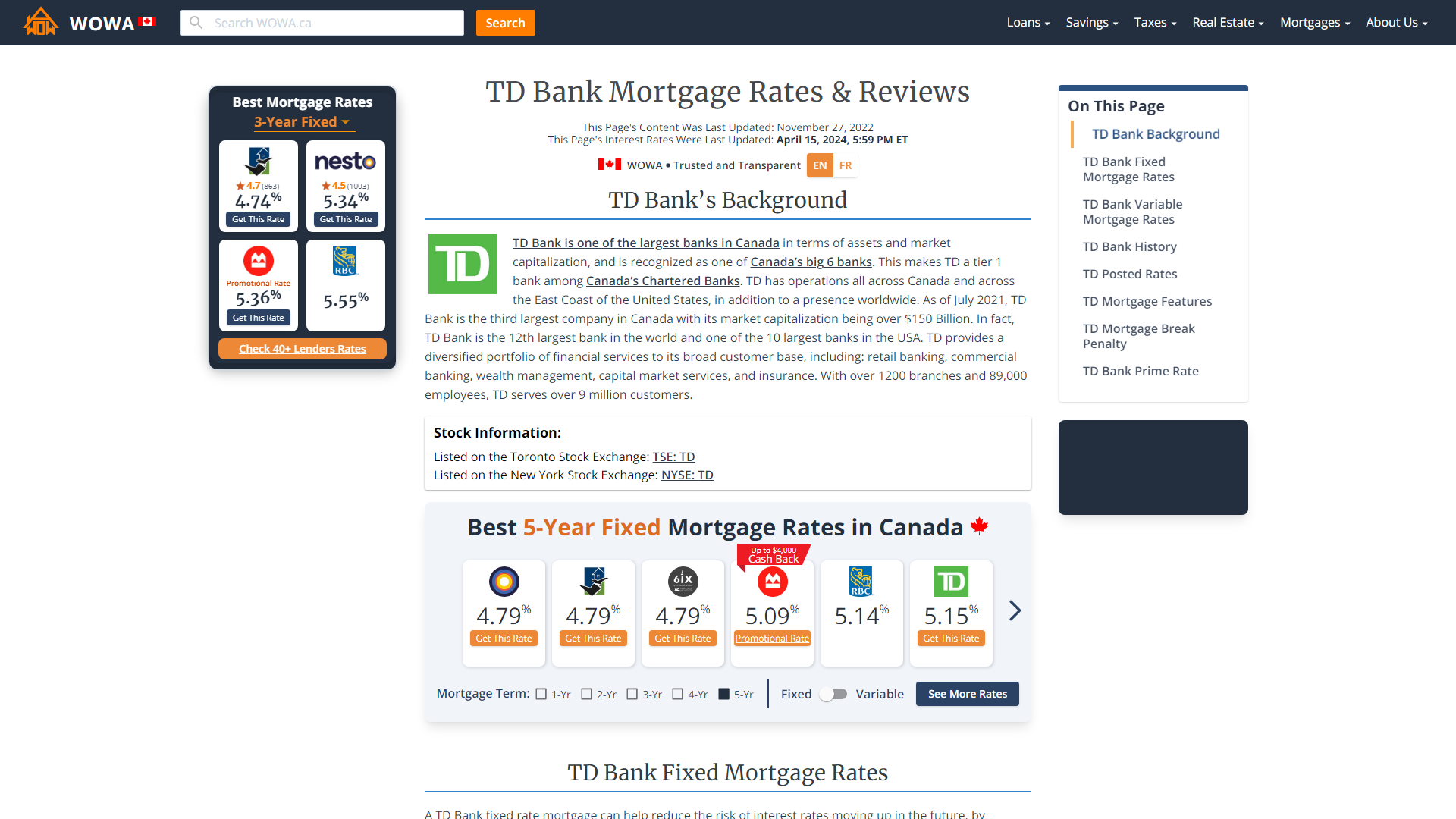

Td Bank Fixed And Variable Mortgage Rates Aug 2022 Special 2 74 Wowa Ca

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Mortgage Bank Overview How It Functions Income Sources

7 Things You Didn T Know About Australian Mortgages Mortgage Brokers Mortgage Tips Mortgage

Real Estate Marketing 50 Real Estate Social Media Posts Etsy In 2022 Social Media Post Real Estate Marketing Instagram Template

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Md43bmvfbn5lam

How To Get Your Mortgage Pre Approval In Uae Preapproved Mortgage Mortgage Mortgage Approval

Pin On Finance Infographics

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

Chip Reverse Mortgage Rates Homeequity Bank

Residential Mortgage Industry Report Cmhc

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Mortgage Brokers Vs Banks

Turned Down For A Mortgage By Your Bank Why Did It Happen And What To Do Next